Matalia

Matalia

5 May 2025

DEFENCE BASKET

Matalia Stock Broking Pvt Ltd brings to you fine-tuned Defence basket. We have summarized the outlook of defence sector, analyzed basket of 7 defence stocks and compared with Nifty 500 performance using Calmar Ratio, Sharpe Ratio, Drawdown cycles, and absolute trailing returns. Download Now

Read MoreMatalia

5 May 2025

SECTORAL INDICES

Matalia Stock Broking Pvt Ltd brings to you trailing returns of sectoral indices showcasing 1 month, 1 year, 2 year, & 3 year returns. Download Now

Read MoreMatalia

5 May 2025

MULTICAP BASKET

Matalia Stock Broking Pvt Ltd brings to you multicap basket. The criteria used for screening are high ROE, low debt to equity ratio, & lower EPS variability. The multicap basket will be rebalanced every quarter. Concentration risk is also mitigated ensuring no single stock has been allocated more than 5 percent. Download Now

Read MoreMatalia

8 November 2023

DIWALI 2023 PICKS

Matalia Stock Broking Pvt Ltd brings you a Diwali basket. We have selected some promising stocks that on technical and fundamental parameters have the strength and potential to yield decent returns. Download Now

Read MoreMatalia

11 August 2023

Markets Today

Please find detailed daily market updates for August 11th 2023 below. Download

Read More

Matalia

7 August 2023

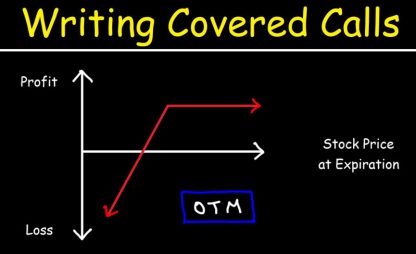

Covered Call Writing

Introduction In a covered call trading strategy, the trader sells a call option while also owning the underlying security. The strategy limits the upside profit potential of the underlying but does not offer protection if the stock price of the underlying falls. The major risk with the strategy is having to hold underlying for a … Covered Call Writing

Read More

Matalia

25 June 2023

Derivatives Taxation

Introduction As per Income Tax Act, Income from F&O trading is treated as business income. Business income is normally divided into speculative and non-speculative income. F&Os are used for hedging and for taking/giving delivery of underlying contracts. Hence, F&O income will be considered a non-speculative business. Deductions & Set Offs Deductions can be taken for … Derivatives Taxation

Read More

Matalia

6 June 2023

INDIAN BANKING CORRELATION ANALYSIS

Notable Findings The 20 day rolling correlation analysis has been performed on banks which are major constituents of both Bank Nifty and Finnifty starting from Jan 2017 to May 2023. Some interesting conclusions drawn out are as follows: * The correlation between Bank Nifty and Finnifty during certain times has dropped below 0.8 from the … INDIAN BANKING CORRELATION ANALYSIS

Read More

Matalia

6 June 2023

Section 54EC

Introduction A long-term capital gain is any revenue that you get from the sale of an asset. The asset could be land, property or even investments. According to the Income Tax Act, you are liable to pay tax for such gains. However, you can reduce the liability of these taxes. Invest in section 54EC bonds, … Section 54EC

Read More

Matalia

8 April 2023

Bond vs Fixed Deposit vs Debt Mutual Fund Taxation

Fixed Deposit Taxation Earning of fixed deposit interest is fully taxable under “Income From Other Sources”. Tax on FD depends tax bracket of an individual. TDS is applicable on interest on FD when an amount interest increase by Rs 40000 per annum, 10% TDS will be deducted by bank at time of credited interest annually. … Bond vs Fixed Deposit vs Debt Mutual Fund Taxation

Read More